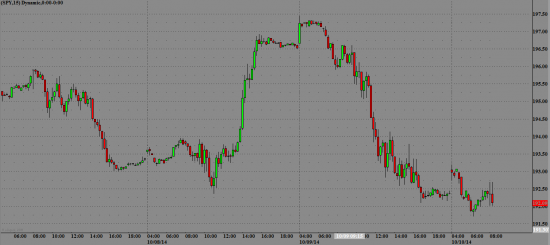

SPY стоит на месте на премаркете

Ближайший уровень поддержки по SPY – 189.50 уровень сопротивления – 191.00

AVGO возможен откат вверх от 71

FFIV продажа ниже 107 выше 108 покупка

SVXY смотрим на откат вверх выше 62

SM при удержании 60,50 покупка

LRCX смотрим на покупку выше 66

CAVM следим за акцией

CPA продажа ниже 100,50

Gapping up/down: APL and ATLS +13% on M&A related news; Ebola related names trading higher, SPLK +2% on upgrade; LAD -10% and GY -3% after earnings, JCP and CLF -1% on dg's Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: MDXG +4.3%

M&A news: APL +12.8% (Targa Resources Partners and Targa Resources Corp. (TRGP) to acquire Atlas Pipeline Partners, L.P. (APL) and Atlas Energy, L.P. (ATLS)), ATLS +12.5%, CSX +9.2% (was approached for M&A deal with Canadian Pacific (CP) but CSX refused it, according to reports), TRGP +1.9%.

Select EU related names showing strength: NOK +2.3%, HSBC +2.1%, SAN +1.9%, YNDX +1.4%, RBS +1.1%, DB +0.9%

Select Ebola related stocks trading higher: IBIO +78.9% (outpacing strength seen this morning in most Ebola related names; checking around for company specific catalyst), HEB +20.6%, APT +18.7% (masks), LAKE +17.5% (masks), NLNK +4.7%, TKMR +4.1%, MLNX +2.2%, INO +1.1%, BCRX +0.7%, SIGA +0.7%

Select metals/mining stocks trading higher: MT +5%, RIO +4%, VALE +3.2%, BHP +2.7%, AU +2.3%, IAG +1.3%, GDX +1.3%, IAG +1.3%, ABX +1%

Select oil/gas related names showing strength: PBR +6.7%, SDRL +5.7%, TOT +1.6%, RIG +1.4%

Other news: DRL +66.4% (wins in Puerto Rico tax case), AHPI +7.6% (cont momentum), SHLD +4.9% (Kmart investigating payment system intrusion), AIXG +4.8% (Allianz Global Investors discloses 10.03% passive stake in 13G filing), KSU +2.6% (CSX peer), PXD +2.5% (Reliance Industries may sell PXD joint venture for $4.5 bln, according to reports), STO +1.5% (sells 15.5% share in Shah Deniz to Petronas for $2.2 bln), TASR +1.4% (announced four international orders — Australia, France, the UK, and Poland — for TASER brand next generation Smart Weapons).

Analyst comments: FOMX +8.3% (initiated with an Overweight at Barclays; initiated with a Outperform at Oppenheimer), GOLD +4.8% (upgraded to Buy from Neutral at UBS), TKAI +3.2% (initiated with an Outperform at William Blair), PRQR +3.2% (initiated with a Buy at H.C. Wainwright), SPWR +3% (upgraded to Outperform from Mkt Perform at Raymond James), SPLK +2.4% (upgraded to Outperform from Mkt Perform at William Blair), AZN +2.3% (upgraded to Buy from Hold at Jefferies), INFY +2% (upgraded to Buy form Hold at Deutsche Bank), TILE +2% (upgraded to Overweight from Equal Weight at Barclays), OUTR +1.9% (upgraded to Neutral from Sell at B. Riley & Co), SFUN +1.4% (upgraded to Buy from Hold at Deutsche Bank), TMUS +0.7% (upgraded to Outperform from Neutral at Macquarie)

Gapping down

In reaction to disappointing earnings/guidance: LAD -10.5%, GY -2.9%

M&A news: DG -1.2% (receives second request from FTC, as expected, regarding proposed acquisition of Family Dollar (FDO))

Other news: GTAT -23.5% (cont vol pre-mkt), LAD -10.5% (still checking), SFLY -7.9% (PE firm Silver Lake abandons attempt to acquire and combine Shutterly and Snapfish, according to reports), LUX -7.2% (Enrico Cavatorta to submit to the Board his resignation as CEO, also downgraded to Neutral from Buy at Citigroup), GPRO -1.8% (cont vol pre-mket), MBLY -1.2% (cautious Barrons mention)

Analyst comments: STM -2.3% (downgraded to Neutral from Overweight at JP Morgan, downgraded to Underweight from Equal-Weight at Morgan Stanley), NGD -1.8% (downgraded to Neutral from Overweight at JP Morgan), JCI -1.2% (downgraded to Outperform at RBC Capital Mkts), CLF -1% (downgraded to Neutral from Overweight at JP Morgan), JCP -1% (downgraded to Sell from Neutral at UBS), CME -0.5% (downgraded to Market Perform from Outperform at Wells Fargo)

Оригинал статьи: gtstocks.com/analytics-13-10-2014.html

AVGO возможен откат вверх от 71

FFIV продажа ниже 107 выше 108 покупка

SVXY смотрим на откат вверх выше 62

SM при удержании 60,50 покупка

LRCX смотрим на покупку выше 66

CAVM следим за акцией

CPA продажа ниже 100,50

Gapping up/down: APL and ATLS +13% on M&A related news; Ebola related names trading higher, SPLK +2% on upgrade; LAD -10% and GY -3% after earnings, JCP and CLF -1% on dg's Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: MDXG +4.3%

M&A news: APL +12.8% (Targa Resources Partners and Targa Resources Corp. (TRGP) to acquire Atlas Pipeline Partners, L.P. (APL) and Atlas Energy, L.P. (ATLS)), ATLS +12.5%, CSX +9.2% (was approached for M&A deal with Canadian Pacific (CP) but CSX refused it, according to reports), TRGP +1.9%.

Select EU related names showing strength: NOK +2.3%, HSBC +2.1%, SAN +1.9%, YNDX +1.4%, RBS +1.1%, DB +0.9%

Select Ebola related stocks trading higher: IBIO +78.9% (outpacing strength seen this morning in most Ebola related names; checking around for company specific catalyst), HEB +20.6%, APT +18.7% (masks), LAKE +17.5% (masks), NLNK +4.7%, TKMR +4.1%, MLNX +2.2%, INO +1.1%, BCRX +0.7%, SIGA +0.7%

Select metals/mining stocks trading higher: MT +5%, RIO +4%, VALE +3.2%, BHP +2.7%, AU +2.3%, IAG +1.3%, GDX +1.3%, IAG +1.3%, ABX +1%

Select oil/gas related names showing strength: PBR +6.7%, SDRL +5.7%, TOT +1.6%, RIG +1.4%

Other news: DRL +66.4% (wins in Puerto Rico tax case), AHPI +7.6% (cont momentum), SHLD +4.9% (Kmart investigating payment system intrusion), AIXG +4.8% (Allianz Global Investors discloses 10.03% passive stake in 13G filing), KSU +2.6% (CSX peer), PXD +2.5% (Reliance Industries may sell PXD joint venture for $4.5 bln, according to reports), STO +1.5% (sells 15.5% share in Shah Deniz to Petronas for $2.2 bln), TASR +1.4% (announced four international orders — Australia, France, the UK, and Poland — for TASER brand next generation Smart Weapons).

Analyst comments: FOMX +8.3% (initiated with an Overweight at Barclays; initiated with a Outperform at Oppenheimer), GOLD +4.8% (upgraded to Buy from Neutral at UBS), TKAI +3.2% (initiated with an Outperform at William Blair), PRQR +3.2% (initiated with a Buy at H.C. Wainwright), SPWR +3% (upgraded to Outperform from Mkt Perform at Raymond James), SPLK +2.4% (upgraded to Outperform from Mkt Perform at William Blair), AZN +2.3% (upgraded to Buy from Hold at Jefferies), INFY +2% (upgraded to Buy form Hold at Deutsche Bank), TILE +2% (upgraded to Overweight from Equal Weight at Barclays), OUTR +1.9% (upgraded to Neutral from Sell at B. Riley & Co), SFUN +1.4% (upgraded to Buy from Hold at Deutsche Bank), TMUS +0.7% (upgraded to Outperform from Neutral at Macquarie)

Gapping down

In reaction to disappointing earnings/guidance: LAD -10.5%, GY -2.9%

M&A news: DG -1.2% (receives second request from FTC, as expected, regarding proposed acquisition of Family Dollar (FDO))

Other news: GTAT -23.5% (cont vol pre-mkt), LAD -10.5% (still checking), SFLY -7.9% (PE firm Silver Lake abandons attempt to acquire and combine Shutterly and Snapfish, according to reports), LUX -7.2% (Enrico Cavatorta to submit to the Board his resignation as CEO, also downgraded to Neutral from Buy at Citigroup), GPRO -1.8% (cont vol pre-mket), MBLY -1.2% (cautious Barrons mention)

Analyst comments: STM -2.3% (downgraded to Neutral from Overweight at JP Morgan, downgraded to Underweight from Equal-Weight at Morgan Stanley), NGD -1.8% (downgraded to Neutral from Overweight at JP Morgan), JCI -1.2% (downgraded to Outperform at RBC Capital Mkts), CLF -1% (downgraded to Neutral from Overweight at JP Morgan), JCP -1% (downgraded to Sell from Neutral at UBS), CME -0.5% (downgraded to Market Perform from Outperform at Wells Fargo)

Оригинал статьи: gtstocks.com/analytics-13-10-2014.html